A T2202 Tuition and Enrolment Certificate is issued each February to students who have paid fees for eligible courses that can be claimed on a Canadian income tax return.

You can claim the tuition fees for courses taken in the calendar year. To qualify, the fees paid to UBC Extended Learning (ExL) must be more than $100 for the year.

Please refer to the Canada Revenue Agency for all definitions and current information.

Please note that Form T2202 replaced Form T2202A in 2019 and subsequent years.

How to download your T2202 Tuition and Enrolment Certificate

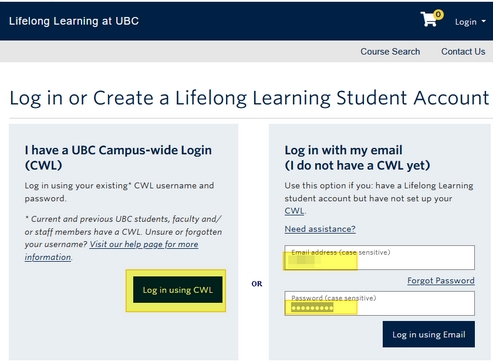

1. Log in to the UBC Lifelong Learning Student Portal.

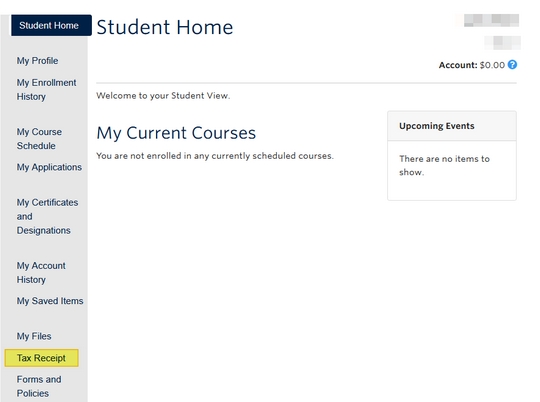

2. From the Student Home menu choose Tax Receipt.

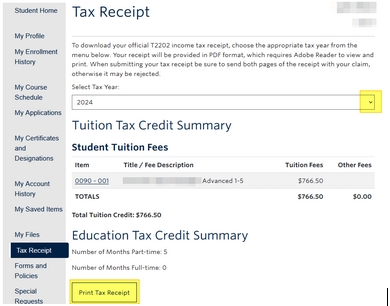

3. Select the desired tax year and click Print Tax Receipt.

How to add your social insurance number (SIN) to your student profile

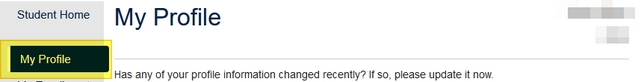

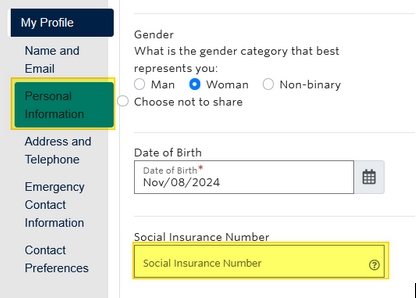

1. In the student portal click on My Profile:

2. Click on Personal Information.

3. Enter or modify your Social Insurance Number (SIN).

If the Social Insurance Number field is blank, the institution will not be able to include your T2202 eligible amounts in their report to the CRA for the tax year. You can enter or modify your SIN at any time.